michigan sales tax exemption rules

The manufacturer will fill out and send in one form for each of their qualifying vendors. Minimum 6 maximum 15000 per month.

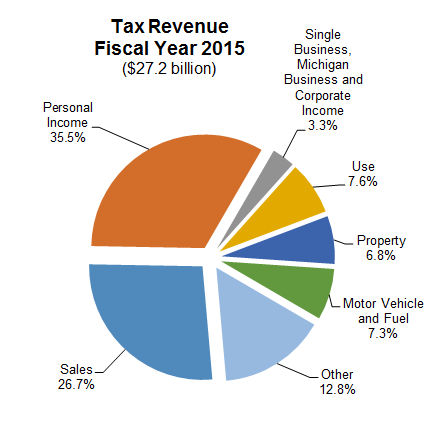

A First Look At Gov Gretchen Whitmer S 2022 State Budget Mlpp

Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

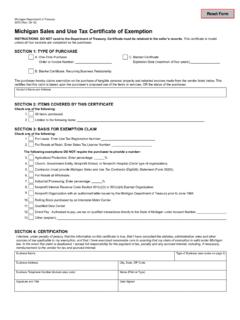

. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Use tax is a companion tax to sales tax. What Is A Sales Tax Exemption information registration support.

On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from. Michigan has a statewide sales tax rate of 6 which has been in place since 1933. GENERAL SALES TAX ACT Act 167 of 1933.

01-21 Michigan Sales and Use Tax Certificate of Exemption. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Several examples of exemptions to the states.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Purchases or payment of services must be made directly from Michigan State University in order to claim exemption. Sales Tax Exemptions in Michigan.

Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax. Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Ad Fill Sign Email MI Form 5076 More Fillable Forms Register and Subscribe Now.

This page discusses various sales tax exemptions in Michigan. Not liable under this act for delivery charges allocated to the delivery of exempt property. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet by mail or by phone from out-of-state retailers that do not collect and remit sales or use tax from their.

An on-time discount of 05 percent on the first 4 percent of the tax. Interstate fleet motor carriers who qualify for exemption may claim exemption from sales or use tax by providing the seller or lessor with the prescribed Michigan Sales and Use Tax Certificate of Exemption form 3372. Most common agricultural input expenses are exempt from Michigan Sales Tax.

To be eligible for the sales tax exemption the purchase must be. This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

V Installation charges incurred or to be incurred before the completion of the transfer of ownership of. RAB 2016-18 Sales and Use Tax in the Construction Industry. Maximum 20000 per month.

Streamlined Sales and Use Tax Project. 4210 MFWD Ehydro--89 JD 318. Rendered Wednesday July 20 2022 Page 1 Michigan Compiled Laws Complete Through PA 134 of 2022.

Michigan Department of Treasury 3372 Rev. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which. Michigan State University Extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax.

This form can be found on the Michigan Department of Treasurys website. Sales exempt from tax. 1 Subject to subsection 2 the following are exempt from the tax under this act.

Thursday June 10 2021. Ad New State Sales Tax Registration. The buyer or lessee would check the box Rolling Stock purchased by an Interstate Motor Carrier.

My wife and I are buying a used motorhome from my in laws and here in Michigan such a transaction is exempt from the 6 percent state sales tax normally collected on motor vehicle sales. If you have questions about state sales tax exemptions please contact taxreportingctlrmsuedu or 517-355-5029. As of March 2019 the Michigan Department of Treasury offers.

What transactions are generally subject to sales tax in Michigan. Michigan Compiled Laws Complete Through PA 134 of 2022 House. The maximum local tax rate allowed by.

A A sale of tangible personal property not for resale to a nonprofit school nonprofit hospital or nonprofit home for the care and maintenance of children or aged individuals operated by an. All claims are subject to audit. Warren Schauer Michigan State University Extension - March 20 2013.

Adjourned until Wednesday August 17 2022 13000 PM. Nov 2 2003. Tax on sale of food or drink from vending machine.

Do not send a copy to Treasury unless one is requested. Michigan sales tax and farm exemption. An early discount of 075 percent on the first 4 percent of the tax if paid by the 12th of the month.

The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form 3372.

Forms and exemption certificates can be found at Tax Services Forms Download web page. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits. 1 Made and paid for directly by the University including a University purchasing card.

A Complete Guide To Michigan Payroll Taxes

How To Fill Out The Michigan Articles Of Organization Startingyourbusiness Com

50 Free Policy Brief Templates Ms Word ᐅ Templatelab

Tax Administration And Tax Systems Joel Slemrod University Of Michigan Tax Administration Research Centre University Of Exeter March 10 Ppt Download

Michigan E File Sales Use And Withholding Suw And City Income Tax Withholding Ctyw Tax Preparer

Michigan Sales Tax Small Business Guide Truic

Gov T Affairs News Personal Income Tax Tobacco 21 And More Michigan Retailers Association

Certificate Of Exemption Streamlined Sales And Use Tax Purchase Pdf4pro

Michigan Levies A Total Tax On Lodging Of 12 Fifth Highest In U S Michigan Thecentersquare Com

Individuals Use The Option Of Filing An Amendedtaxreturn When He Or She Comes To Know That There Is An Error In His Al Income Tax Tax Consulting Tax Extension

Since The Tampon Tax Was Axed Michigan Lawmakers Look To Cut Taxes On Other Products Michigan Advance

Michigan House Senate Pass Economic Development Incentives Business Relief Funds And Personal Property Tax Exemption Increase Grand Rapids Chamber